Featured Resource

The MTD IT Bootcamp - MTD IT – The journey so far and the big opportunity - 24 June

Tuesday 24 June 2025

Learn everything you need to know about HMRC’s digital mandate with this webinar series from Dext.

Indulge in our recent webinars

A Guide to Growing Your Bookkeeping Practice

Unlock the Blueprint to Sustainable Growth for Your Bookkeeping Practice with this webinar from Capium.19 Jun 25•Capium

Voices of Sustainability

Join the experts to explore how technology and advisory roles are shaping sustainable business.19 Jun 25•Spotlight Reporting

Capture, Connect, Collaborate for Smarter Accounting

Capium 365 Essentials for MTD IT Webinar18 Jun 25•Capium

ApprovalMax - June Product Update 2025

Join ApprovalMax for the latest updates.18 Jun 25•ApprovalMax

Read the latest news articles

Karbon Update Launch

Karbon launches end-to-end tax workflows, AI innovations, and Practice Intelligence to accelerate firm growth20 Jun 25•Karbon

ApprovalMax Product Update

Learn more about the latest updates from ApprovalMax and take control of your budgets.20 Jun 25•ApprovalMax

Capium Helps Scale Accountancy Practice

How Capium Helped Jermyn & Co Scale Their Accountancy Practice20 Jun 25•Capium

Top 20 Benefits of Artificial Intelligence (AI) – With Examples That Matter

Here are 20 key benefits of artificial intelligence, packed with real-life examples to how Zahara uses AI behind the scenes16 Jun 25•Zahara

Check out our blog

How to Conduct an Appraisal: Employer’s Guide

In this article, Factorial run through what’s involved in a performance appraisal, talk about some of the challenges that can arise and how best to prepare and finish with eight tips to help you learn how to do an appraisal.20 Jun 25•Factorial HR

The State of AI in Accounting Report 2025

How do accounting professionals feel about the impact of AI? How are they using AI at their firms? Find out in the most comprehensive global study on AI usage, perceptions, and attitudes within the accounting community.19 Jun 25•Karbon

What’s your bigger thing?

Are you growing a business, launching something new, or chasing a lifelong dream? Dext is here to help you make it happen with a competition to win £5,000 in cash to take the next step.19 Jun 25•Dext &Dext Commerce&Dext Precision

Frequently asked questions about P45s

To help you get up to speed with the ins and outs of the P45, FreeAgent have answered some of the most common questions they get about P45s.16 Jun 25•FreeAgent

Browse all our resources(1283)

- Webinars

- News

- Blog

- All

- Webinars

- News

- Blog

- WebinarsUpcoming

Dext - Global Partner Updates, 2025

Plan ahead, stay informed, and maximise your Dext experience! Sign up to the Dext 2025 Global Partner Update webinar series.22 Jul 25•Dext - WebinarsUpcoming

How to use outsourcing to implement MTD for Income Tax

Join Capium for this insightful practical webinar to explore how outsourcing can play a vital role in helping practices implement MTD IT successfully.16 Jul 25•Capium - WebinarsUpcoming

Capium & AML: Keeping Your Practice Audit-Ready

Get AML Compliance Right — Without the Stress with this webinar from Capium15 Jul 25•Capium - WebinarsUpcoming

Discover the Capium Accounting Suite

See the Capium Accounting Suite in Action in this webinar from Capium25 Jun 25•Capium - WebinarsUpcoming

The MTD IT Bootcamp - MTD IT – The journey so far and the big opportunity - 24 June

Learn everything you need to know about HMRC’s digital mandate with this webinar series from Dext.24 Jun 25•Dext - Blog

How to Conduct an Appraisal: Employer’s Guide

In this article, Factorial run through what’s involved in a performance appraisal, talk about some of the challenges that can arise and how best to prepare and finish with eight tips to help you learn how to do an appraisal.20 Jun 25•Factorial HR - News

Karbon Update Launch

Karbon launches end-to-end tax workflows, AI innovations, and Practice Intelligence to accelerate firm growth20 Jun 25•Karbon - News

ApprovalMax Product Update

Learn more about the latest updates from ApprovalMax and take control of your budgets.20 Jun 25•ApprovalMax - News

Capium Helps Scale Accountancy Practice

How Capium Helped Jermyn & Co Scale Their Accountancy Practice20 Jun 25•Capium - Blog

The State of AI in Accounting Report 2025

How do accounting professionals feel about the impact of AI? How are they using AI at their firms? Find out in the most comprehensive global study on AI usage, perceptions, and attitudes within the accounting community.19 Jun 25•Karbon - Blog

What’s your bigger thing?

Are you growing a business, launching something new, or chasing a lifelong dream? Dext is here to help you make it happen with a competition to win £5,000 in cash to take the next step.19 Jun 25•Dext &Dext Commerce&Dext Precision - Webinars

A Guide to Growing Your Bookkeeping Practice

Unlock the Blueprint to Sustainable Growth for Your Bookkeeping Practice with this webinar from Capium.19 Jun 25•Capium - Webinars

Voices of Sustainability

Join the experts to explore how technology and advisory roles are shaping sustainable business.19 Jun 25•Spotlight Reporting - Webinars

Capture, Connect, Collaborate for Smarter Accounting

Capium 365 Essentials for MTD IT Webinar18 Jun 25•Capium - Webinars

ApprovalMax - June Product Update 2025

Join ApprovalMax for the latest updates.18 Jun 25•ApprovalMax - Webinars

Global Advisory Trends Report 2025

Spotlight Reporting are back with the next edition of their hugely popular Global Advisory Trends Report!18 Jun 25•Spotlight Reporting - Webinars

How to Use Reporting Tools To Actually Help Your Clients

Free masterclass from Spotlight Reporting for CPAs, Accountants and Bookkeepers17 Jun 25•Spotlight Reporting - Blog

Frequently asked questions about P45s

To help you get up to speed with the ins and outs of the P45, FreeAgent have answered some of the most common questions they get about P45s.16 Jun 25•FreeAgent - News

Top 20 Benefits of Artificial Intelligence (AI) – With Examples That Matter

Here are 20 key benefits of artificial intelligence, packed with real-life examples to how Zahara uses AI behind the scenes16 Jun 25•Zahara - Blog

Dominate with World-Class AI Tech: Your Path to Go-To Firm Status

How Top Firms Are Using AI to Turn Client Data into Revenue13 Jun 25•XBert - News

Management Reports have landed: what’s new and what’s to come

FreeAgent unveil the next big step in that journey: Management Reports.13 Jun 25•FreeAgent - Blog

Free 1-on-1 sessions with Firmcheck

Get your Companies House ID verifications plan sorted with a free 1-on-1 session with Firmcheck12 Jun 25•Firmcheck - Webinars

ApprovalMax - Building best-in-class approval workflows for finance teams

Join Justin Campbell & James Lin from ApprovalMax to see how leading finance teams have streamlined their approval processes, all while maintaining the compliance standards your business demands.11 Jun 25•ApprovalMax - Blog

Why 2025 is the year to embrace cloud accounting

What makes 2025 the tipping point for cloud adoption? And how can it transform the way you work? Capium explore why this is the year to make the switch.10 Jun 25•Capium - Blog

AML Essential Kit - Firm-wide risk assessments

The next instalment from Firmchecks AML Essential Kit covers firm-wide risk assessments.10 Jun 25•Firmcheck - Blog

Top Behaviours of Leaders for Effective Management

In this article, Imogen Hall from Factorial looks at the top behaviours of leaders and how you can implement them in your daily work.10 Jun 25•Factorial HR - Blog

Turning ADHD challenges into strengths in the accounting world

In this blog from Karbon, Sharrin Fuller explains why ADHD is an advantage in the accounting world, and shares the tips she uses to harness her own ADHD superpowers.10 Jun 25•Karbon - Webinars

Time for Dext: Mini-series - Time for optimisation

Discover the value of smarter bookkeeping10 Jun 25•Dext - News

AI in Accounting automates hours of financial analysis in seconds

How XBert’s P&L Review and XI Community make AI simple10 Jun 25•XBert - Blog

Dext The Ultimate MTD IT Toolkit

Three essential guides in one place. Everything you need to make MTD IT simple and stress-free.9 Jun 25 - Blog

Six key priorities for finance teams in 2025

To understand how finance teams are tackling 2025, ApprovalMax, Mayday, and Joiin asked finance professionals about their plans and priorities. Here's what they're focusing on this year.9 Jun 25•ApprovalMax - News

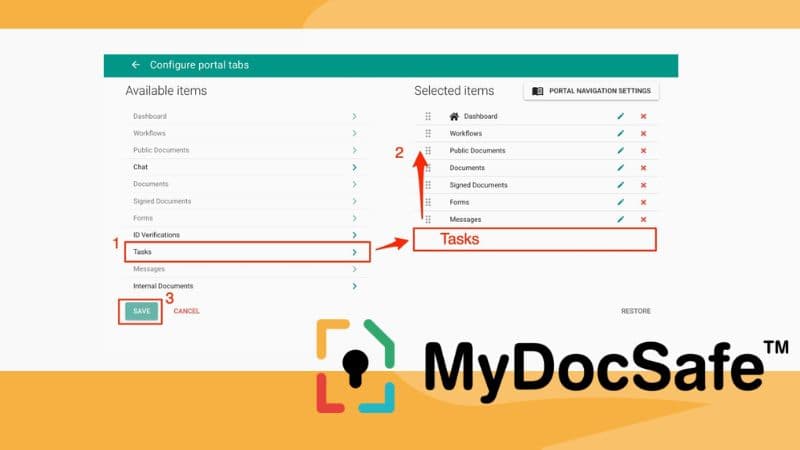

MyDocSafe - June 2025 release notes

Read the June updates and release notes from MyDocSafe.9 Jun 25•MyDocSafe - News

Joiin Unwrapped #2: What’s New at Joiin?

Joiin Unwrapped, your go-to update on the latest features, news and developments from the Joiin team.9 Jun 25•Joiin - Blog

8 Marketing Mistakes Accountants Make (and what to do instead)

Insightful article from our gold partner Karbon30 May 25•Karbon - Blog

4 Ready-to-use MTD Email Templates for Your Practice

Useful resources in this blog post from our partner FreeAgent.30 May 25•FreeAgent - Blog

A decade of dedication: Matt’s 10-year journey with Spotlight Reporting

The latest blog post from our partner Spotlight Reporting.30 May 25•Spotlight Reporting - News

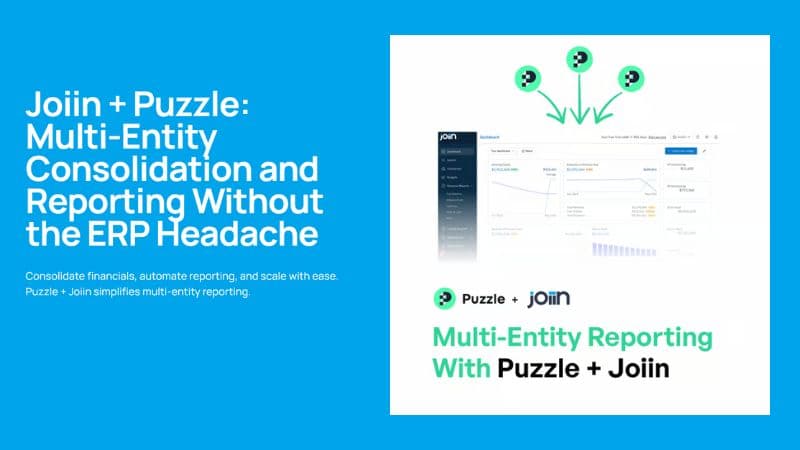

Joiin - New integration with Puzzle

Solving Financial Complexity at Scale: Joiin + Puzzle Integration Delivers Multi-Entity Consolidation Reporting Without the ERP Headache30 May 25•Joiin - Webinars

Dext - Fall in love with workflows

How to build the perfect accounting workflow29 May 25•Dext - Webinars

The State of AI in Accounting 2025: Emerging Trends, Challenges & Opportunities

Discover how progressive accounting firms are using AI to save time, reduce burnout, and unlock growth—based on Karbon’s 2025 AI report.29 May 25•Karbon - Webinars

What's driving finance teams in 2025

Join ApprovalMax and Joiin for this great webinar28 May 25•ApprovalMax - Webinars

Watch our App of the Month - Getting Ready for MTD: Pricing Considerations & Workload Management

We hosted an insightful webinar this month with our App of the Month Dext.28 May 25•Dext - Webinars

The Smartest Way to Tackle MTD IT Compliance

Making Tax Digital for Income Tax (MTD ITSA) is coming — is your practice ready?28 May 25•Capium - Blog

Tariffs: The impact on small businesses

In this article from AirWallex we learn the three ways to protect your margins.27 May 25•Airwallex - Blog

AML Essential Kit - Client data collection

This article is the next instalment from Firmchecks AML Essential Kit covers client data collection26 May 25•Firmcheck - News

Boost your efficiency with accounts payable outsourcing

In this article from Zahara learn how to boost your efficiency with accounts payable outsourcing.26 May 25•Zahara - Blog

Thank You for Joining App Advisory Plus at Accountex London 2025!

Our Accountex 2025 highlights.22 May 25 - Blog

Spotlight Reporting Accountex London 2025

Spotlight Reporting's highlights from Accountex London 202522 May 25•Spotlight Reporting - Blog

Mental health tips every finance professional should know

Free guide and expert insights to help finance teams tackle stress from Iplicit.21 May 25•iplicit - Webinars

How to Price Right, Show Value, and Scope With Confidence

Are you still quoting without reviewing the client file first? In this webinar recording and article XBert explore practical strategies for smarter pricing, clearer scoping, and building confidence in your value.20 May 25•XBert - News

Global Advisory Trends Report 2025

It's live! The Spotlight Reporting Global Advisory Trends Report 2025 is here.20 May 25•Spotlight Reporting - Webinars

Efficient approvals and budgeting: Best practices for the building and construction industry

Join ApprovalMax on the 2nd May for their latest webinar.2 May 25•ApprovalMax - Blog

App Advisory Plus Accountex London - Line Up - 14th & 15th May

Join App Advisory Plus at Accountex London on 14-15 May 2025 at the ExCel London | Stand 1670 & Theatre 91 May 25

Sign up to our newsletter - don't miss out on all the good stuff.

Latest news, events, and updates on all things app related, plus useful advice on app advisory - so you know you are ahead of the game.