For business owners, accountants, and bookkeepers, Xero’s integration with Dext simplifies the uploading of receipts and transactions, boosting efficiency and accuracy while freeing up valuable time for more strategic tasks.

For business owners, accountants and bookkeepers alike, accounting software like Xero can save a huge amount of time and improve efficiency.

Using data uploaded throughout the year, these tools automate and streamline a vast number of business bookkeeping tasks. This frees up business owners to focus on their commercial priorities, while giving accountants and bookkeepers more time to support clients with meaningful advisory work and other value-adding tasks, or personal pursuits.

But what about the process of uploading data like receipts, invoices and bank transactions into the accounting software – isn’t that a time-consuming job in itself? Thanks to Xero’s integration with Dext, the answer is no!

Here’s how Dext helps Xero users capture receipts and upload them to their accounts quickly, accurately, and in high volume.

Xero’s accounting software includes a number of simple workflows for uploading receipts and then recording the corresponding accounting transactions. However, as a business grows, so does the volume and complexity of the data it has to handle. Instead of having one or two receipts to capture every so often, business owners can quickly find themselves with piles of receipts to process.

Before long, data entry becomes tedious and time-consuming. It begins to slow business owners down. They start to rush through it, often making errors along the way, or store it up to process in batches at some point in the future. It takes time away from other work. With other priorities competing for their attention, uploading the data often falls to the bottom of a business owner’s to-do list.

The bottleneck created by this seemingly simple admin task can have big repercussions: without the most up-to-date data, a business’s accounts can quickly become out of date. This means that a complete financial picture is no longer available to either the business owner or their accountant or bookkeeper.

A higher volume of transactions requires an even greater degree of accuracy when it comes to recording the data . Even when business owners are able to stay on top of the mounting financial admin, they simply don’t have time to check that the data has been uploaded to their accounting software correctly.

That’s where Dext’s integration with Xero comes in.

Dext integrates with Xero to provide a fast and accurate way for business owners to upload receipts and keep their accounts up to date – no matter how many receipts they have to process or how complex the data is.

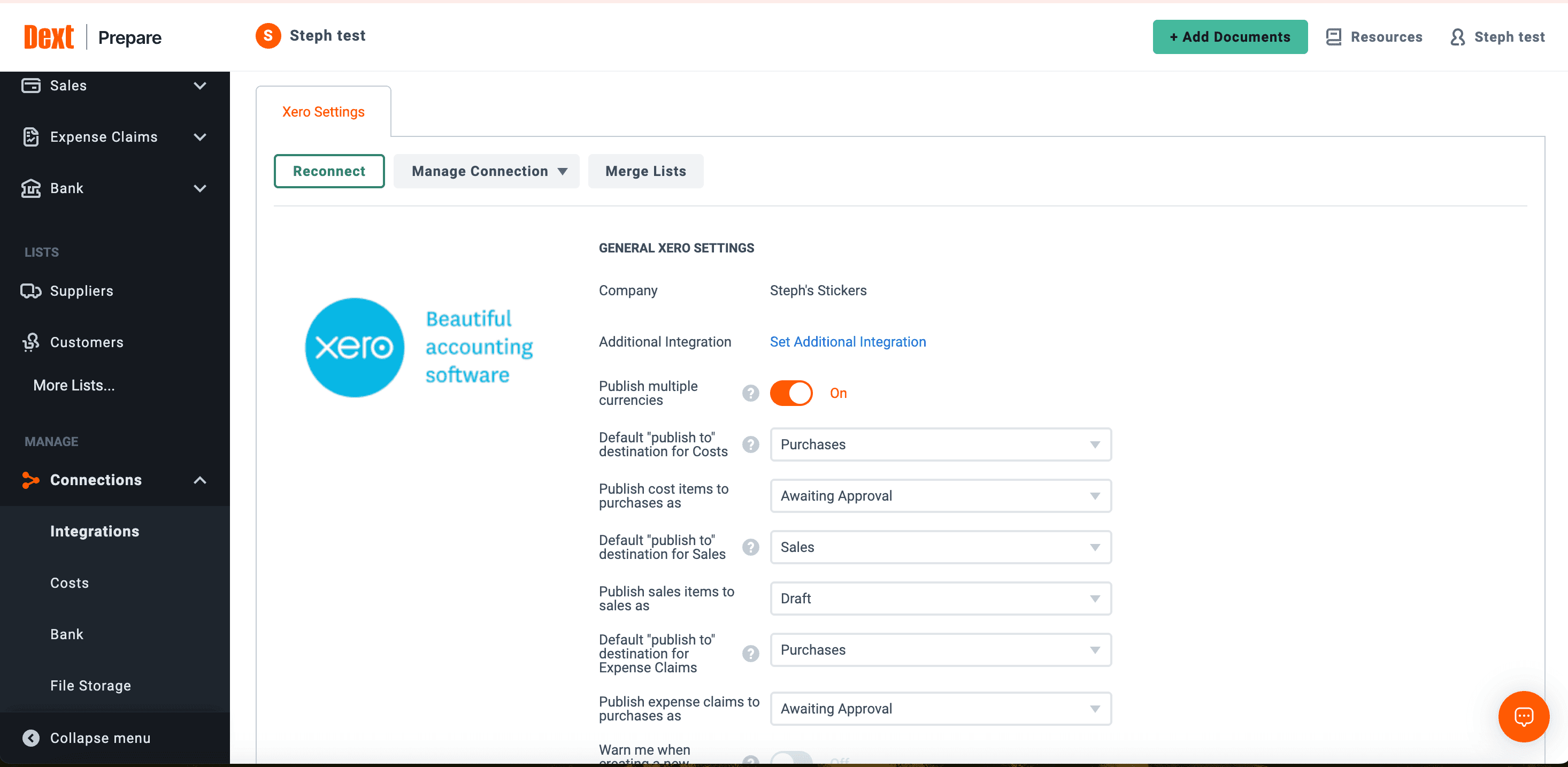

The integration takes just a few clicks to set up. It allows Xero’s customers to leverage the Optical Character Recognition (OCR) technology in Dext to automatically extract data from receipts, invoices and bank statements, and then import it directly into Xero.

Dext uses OCR technology to extract a huge amount of transaction data, including key details like the date and amount, supplier name, currency, tax amount, invoice number, and a whole host of other information.

Get Dext at the Xero app store!

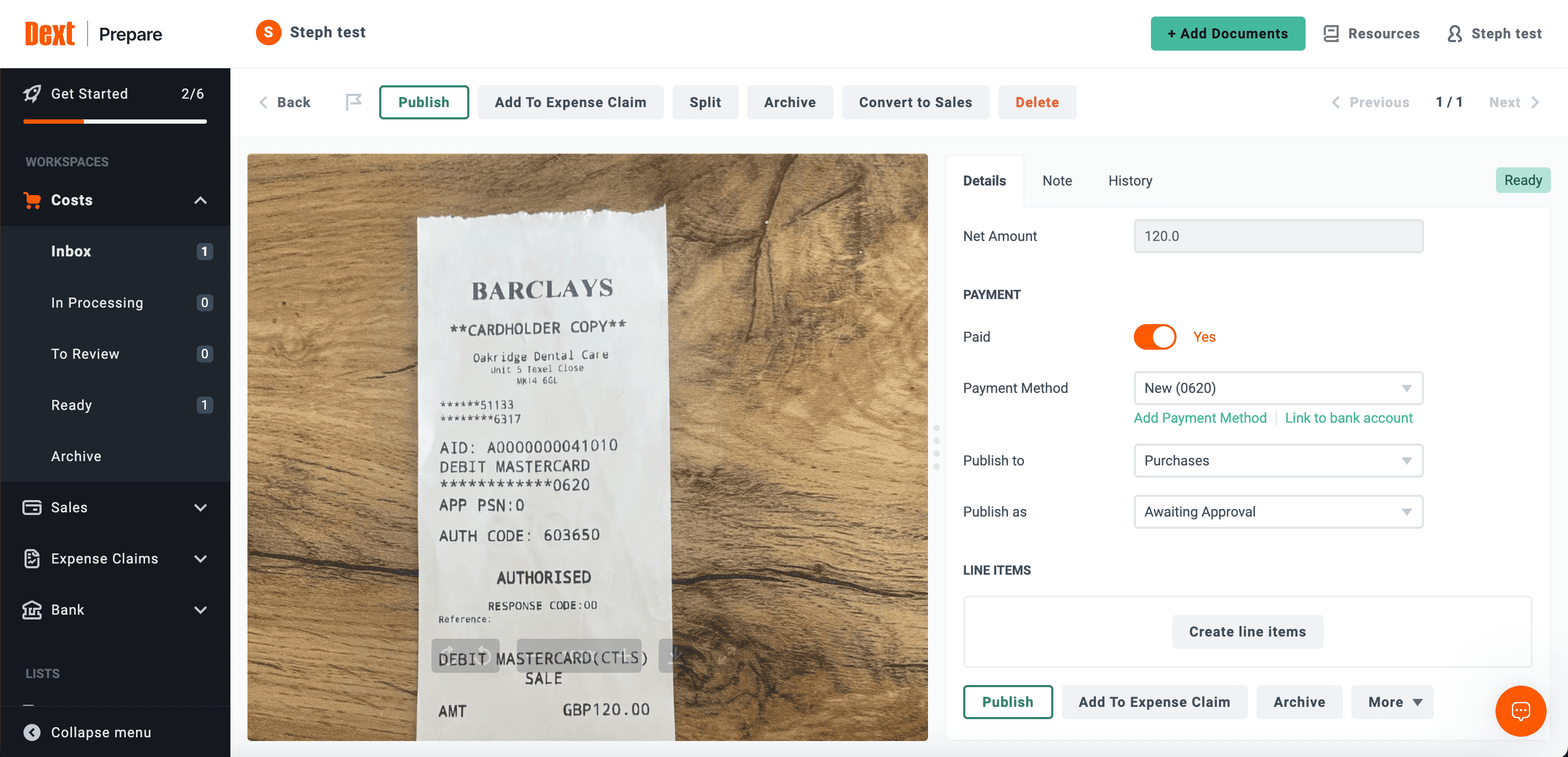

When a business owner incurs an expense, they take a photo of the receipt on the Dext mobile app. Dext then automatically extracts the information on the receipt with 99% accuracy.

Driven by state-of-the-art AI, Dext then suggests a category for the transaction, based on the user’s previous choices. All the business owner has to do is review the details and then publish the data to Xero in a single click.

With the integration enabled, the information flows into Xero seamlessly, updating the business owner’s financial accounts accurately and automatically.

This saves time for everyone involved in the small business accounting process. Business owners can upload receipts with minimal effort, giving accountants and bookkeepers instant access to accurate and up-to-date accounting data in Xero.

Dext also provides additional critical features that streamline bookkeeping within a wider accounting workflow. These include:

• Tracking categories: Dext facilitates the organisation of financial data by allowing users to apply tracking categories that mirror those used in their connected accounting software. This feature ensures that when data is exported to systems like Xero, it aligns with the existing financial structure, maintaining consistency across financial reports and analyses.

• Re-billable expenses: When processing documents related to expenses, Dext provides the capability to tag certain costs as re-billable. These tagged expenses can be grouped and later exported to an accounting system, where they can be billed to clients. This process ensures that all expenses incurred on behalf of a client are accurately documented and reclaimed.

• Payment methods: Dext primarily functions as a tool for extracting and organising financial data from documents such as receipts and invoices. It does not directly manage payments but supports integration with accounting systems such as Xero, which handle these transactions. This integration ensures that all financial data managed through Dext can be seamlessly incorporated into broader financial management practices.

• Supplier categorisation: Dext enables users to create specific rules for automatically sorting expenses according to suppliers. This feature ensures that transactions from recurring suppliers are always categorised consistently in Xero, facilitating smoother financial management and reporting.

• Duplication detection: To uphold the accuracy of your financial records, Dext incorporates a feature that scans for and identifies possible duplicates among your transactions. This preventive measure is essential to ensure that your accounts in Xero remain error-free and reliable.

All of this can be done across multiple payment methods and currencies.

Latest news, events, and updates on all things App related, plus useful advice on App advisory - so you know you are ahead of the game.